Table of Contents

- How to Create Wise Account

- How Wise Transfer Money Works

- Why I Highly Recommend Using Wise

- Essential Tips and Advice for New Users

- Summary

When you're sending money overseas, you likely want to keep the transfer fees as low as possible. You might also be interested in checking the actual exchange rate to see what the final amount you'll receive is. If this sounds like you, this article will introduce you to Wise (formerly known as TransferWise), a service that makes international transfers truly convenient.

Wise (previously known as TransferWise) is a global money transfer service that stands out for its speed and low cost, boasting 13 million users worldwide. Founded in 2011 by two ex-Skype and Deloitte consultants, Wise has its headquarters in London and offices around the world. The founders created a unique peer-to-peer (P2P) transfer model that allows for faster, cheaper, and more transparent international money transfers than traditional banks.

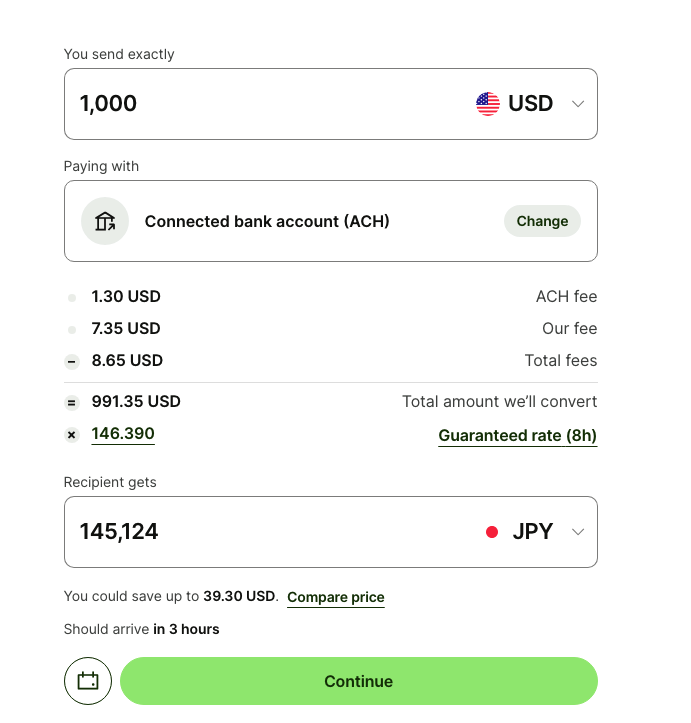

One of the main benefits of using Wise is that it uses the real exchange rate for transfers, meaning users don't have to worry about hidden fees and can check the exchange rate at the time of transfer. This makes Wise an attractive option for those looking to save on transfer costs. It also provides a clear overview of the transfer process, including how long it will take for the money to arrive.

Wise has expanded its services to offer a broader range of financial products, including multi-currency accounts for both individuals and businesses. Users can hold, exchange, and send money in over 50 currencies with a multi-currency account. Additionally, the Wise debit card allows for easy payments worldwide, including ATM withdrawals during international travels, offering several benefits.

If you're considering creating a Wise account, please take this article for reference and my advice is given.

Finally, I recently joined this Wise Affiliate program and I would like to share my referral link here and mention at the end that offers exclusively for the new joiner.

How to Create Wise Account

For instructions on creating an account, please refer to the official Wise website, which offers easy-to-understand, step-by-step guides. The diverse Wise content writers offer different directions.

How Wise Transfer Money Works

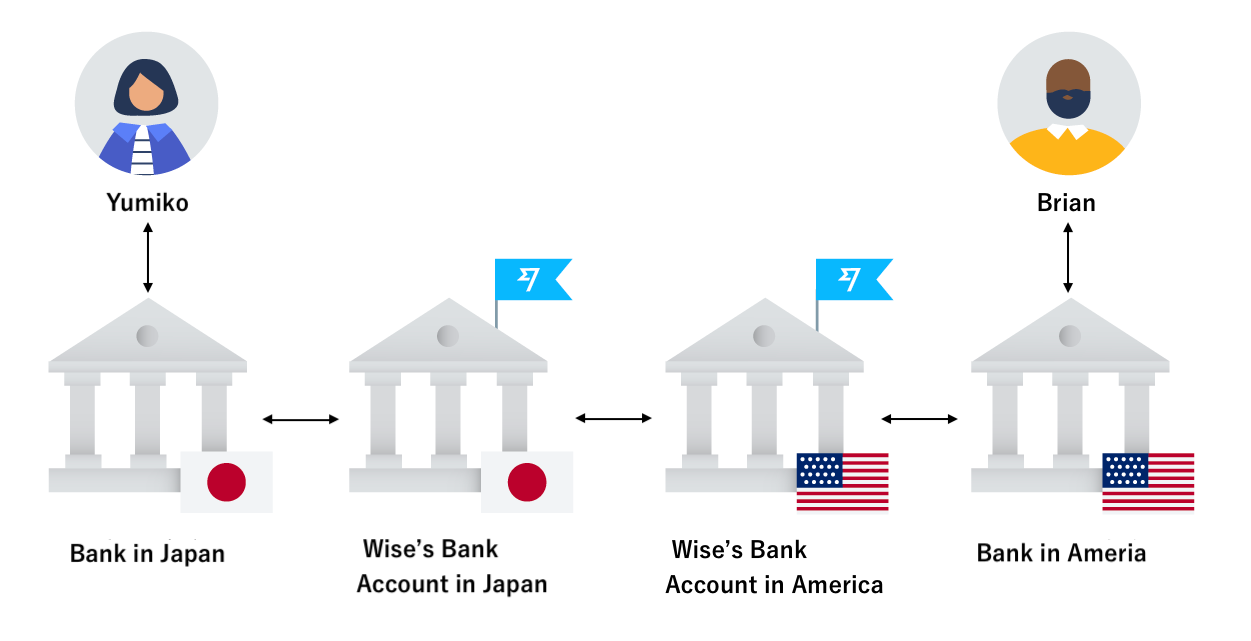

The Wise transfer mechanism simplifies international transfers by utilizing local bank transfers. You send money to Wise's local account in your country, and then Wise transfers the equivalent amount from its account in the recipient's country. This method saves on fees and time compared to traditional international transfers.

Wise

Traditional bank international transfers use SWIFT codes to connect banks across countries in a network. The process involves transferring money through several banks: from the sending bank to intermediary banks and finally to the receiving bank. This chain of transfers results in high fees and long transaction times.

Why I Highly Recommend Using Wise

I've been using Wise (formerly known as TransferWise) for 8 years and here's my personal take. I highly recommend it to people traveling abroad or working with overseas companies. I've never had any issues!

Here are the reasons why I think it's great:

What's impressive about Wise is that it truly offers the cheapest way to send money abroad compared to banks and other services. Here's an example of the rates for sending USD 1,000 internationally.

Wise is also secure. It's authorized by the financial authority in the home country, and the money you send is safeguarded by a legal entity, ensuring your funds are protected in any situation.

Essential Tips and Advice for New Users

You can only have one Wise account per person.

Wise accounts are one per person. Even if you have multiple emails or phone numbers, you can only create one account, similar to having just one passport. Be careful when linking bank accounts. For instance, if you're living abroad and want to send money to a Japanese account, you must open your account with an overseas address and link it to an overseas bank. Conversely, if you want to send money to your home country from a Japanese account, open your account in Japan. You cannot have multiple accounts, so make sure you create the right account for your needs.

Change the sender's name to Wise account ID

When topping up your Wise account, change the sender's name in the bank to your Wise account ID to make the process faster. This change ensures your funds are credited quickly, usually within 20 minutes.

Check your email box

You might receive emails for security checks, especially if you frequently send money abroad or log in from an overseas IP. These emails verify your identity, so don't ignore them. Failing to complete these checks might temporarily disable your account, but you can appeal to have it reactivated after verification.

Understanding display names on transaction statements after international transfers

Regarding the display name on transaction statements after an international transfer, the recipient won't see your name but the local Wise bank's name (Example: MBB CT--WISE Payments US). It's crucial to communicate with the recipient in advance and use the memo or reference field for clarity, like including the invoice number and company name for bill payments.

Summary

In summary, Wise offers many convenient features, such as real-time transfers between accounts and global payments with a debit card. Using the Wise card, you can withdraw cash from your account at ATMs worldwide, which is more cost-effective than currency exchange at airports or downtown. You can pre-set up 4-digit PIN code. Once you insert the card into the ATM, enter 4-digit PIN code then select the "withdraw -> checking or credit card". Wise then automatically exchanges the currency in the account and cashs out from the machine. With a Wise card, accessing local currency in over 60 countries is easy. I recommend creating an account, and if you feel that this article helped you in any way, please kindly join by using my referral link, you can get up to 500 euros in free transfer fees.